PSD2 API

The documentation for the iBanFirst PSD2 API is designed to assist developers, financial institutions, and aggregators in implementing the API specifications mandated by PSD2 (Payment Services Directive 2).

iBanFirst PSD2 API

The iBanFirst’s PSD2 API can be used for both Account Information (AIS) and Payment Initiation Services (PIS).

Our API is certified and iBanFirst is exempted from any fallback mechanism in the context of PSD2.

Since our priority is to secure customer’s data and ensuring a smooth customer experience, our PSD2 API is based on a common “redirect” method (defined in standards such as OAuth2.0).

According to PSD2 regulations, our PSD2 API is totally free for clients.

If you are a registered Third-Party Provider (TPP), with a qualified EIDAS QWAC and wish to use iBanFirst API, please contact us at open-api@ibanfirst.com

Open Banking with PSD2

The revised Payment Services Directive (PSD2) requires banks to allow Third-Party Providers (TPPs) to access account and make payments on their customer’s behalf and with their consent.

This regulation ensures that banks put into place the necessary systems to securely and reliably share their services and data with registered TPP.

APIs are already widely used across the internet to share information and provide secure access to accounts and payment services.

Sandbox Credentials

Our PSD2 API Sandbox is an open environment that allows to experiment, develop and test TPP’s application for the PSD2 services. It covers accounts information, payment initiation and secure customer authentication.

After using the following credentials to register yourself, you can submit API requests and receive simulated responses.

Login: m01148y

Password: AccountPSD2

Authentication: 000000

Test URL: https://open-api-sdbx.ibanfirst.com/Banking/API

EUR IBAN: BE90 9140 0154 4332

USD IBAN: BE68 9140 0154 4534

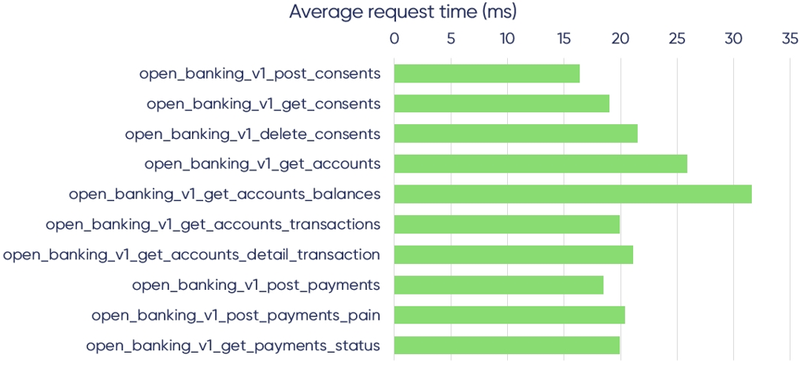

Performance

API Documentation

Empiece hoy mismo

Quiénes somos

iBanFirst S.A. está debidamente autorizada y regulada como entidad de pago por el Banco Nacional de Bélgica con el número de registro mercantil 0849.872.824. Nuestro domicilio social es Avenue Louise 489, 1050 Bruselas, Bélgica. Los productos y servicios ofrecidos por iBanFirst S.A. se limitan a transacciones de divisas al contado no reguladas y seguros de cambio entregables (seguros de cambio, seguros de cambio flexibles y dinámicos) excluidos de la normativa MiFID y EMIR, ya que están destinados a cubrir un pago futuro subyacente por bienes y servicios identificables. iBanFirst S.A. no ofrece opciones ni ningún otro instrumento financiero con fines de inversión o especulativos.